Professional illustration about SoFi

Instant Referral Bonus Guide

Looking to earn instant referral bonuses with no deposit? Many top financial platforms and apps in 2025 offer cash rewards just for inviting friends—no upfront payment needed. Whether you're into mobile banking, investment apps, or side hustles, here’s how to maximize these opportunities.

Popular Platforms with No-Deposit Referral Bonuses

- SoFi and Chase Bank often run limited-time promotions where both you and your friend get cashback or a sign-up bonus (e.g., $50–$100) for opening an account.

- Robinhood and Coinbase frequently offer free cryptocurrency or stock shares (like $5–$25) for successful referrals—perfect for passive income seekers.

- Wealthfront and Charles Schwab cater to investors with referral programs that reward you for bringing in new users, sometimes with bonus cash deposited directly into your account.

- Acorns and Fundrise focus on micro-investing and real estate investing, offering $5–$20 bonuses per referral.

Earning Beyond Banking: Gift Cards & Passive Income

Not just finance apps—platforms like Swagbucks, Survey Junkie, and InboxDollars let you earn gift card redemption or bank transfer rewards for referrals. For freelancers, Fiverr’s affiliate program pays commissions when your invites complete their first gig. Even Dropbox and Hostinger offer cloud storage or web hosting credits for sharing referral links.

Pro Tips to Boost Referral Success

1. Leverage social media: Share your referral links in niche communities (e.g., finance groups for Klarna or TurboTax deals).

2. Time your invites: Apps like Venmo or KashKick often double bonuses during holidays or special events.

3. Be transparent: Explain the no deposit requirement upfront—friends are more likely to sign up if they know there’s no risk.

Avoiding Pitfalls

Watch for expiration dates (e.g., Freecash bonuses may vanish if unused in 30 days) and minimum payout thresholds. Always check the fine print—some programs, like Coursera’s, require the referee to purchase a course before you earn.

By targeting platforms aligned with your network’s interests (e.g., cryptocurrency enthusiasts for Coinbase, students for Coursera), you can turn referrals into a steady stream of passive income. Just remember: consistency and authenticity matter more than spamming links.

Professional illustration about Chase

No Deposit Bonus Tips

No Deposit Bonus Tips

If you're looking to earn money online without spending a dime, no deposit bonuses are a game-changer. Many financial platforms and apps—like SoFi, Chase Bank, Robinhood, and Coinbase—offer cash rewards just for signing up through referral links. Here’s how to maximize these opportunities in 2025:

Not all referral programs are created equal. For example, Charles Schwab and Wealthfront often provide sign-up bonuses ranging from $50 to $500 for new users who link a bank transfer or meet minimal requirements. Meanwhile, apps like Acorns and Fundrise focus on investment and real estate investing perks, such as free stock or fractional shares. Always compare offers—some platforms may require a direct deposit, while others just need an account opening.

Platforms like Venmo, Klarna, and Swagbucks reward users for simple actions, such as linking a debit card or completing surveys. For instance, Survey Junkie and InboxDollars pay cashback for sharing opinions, while KashKick and Freecash let you earn gift card redemption or PayPal cash. The key is consistency—dedicate 10-15 minutes daily to these apps for passive income over time.

Many mobile banking apps bundle no deposit perks with other benefits. SoFi, for example, offers cash rewards for setting up direct deposit, while Chase Bank frequently runs promotions for new checking accounts. If you’re into cryptocurrency, Coinbase occasionally gives free crypto for learning about new coins. Even tax tools like TurboTax provide discounts or cashback for referrals.

Don’t overlook non-banking platforms. Dropbox and Hostinger offer free storage or hosting credits for referrals, while Coursera provides discounts on courses. Freelancers can benefit from Fiverr’s referral system, which rewards both the referrer and the new user. These are great ways to save money while expanding your skills or resources.

With so many earn money online opportunities, it’s easy to lose track. Create a spreadsheet to track referral program deadlines and requirements. Always verify legitimacy—stick to well-known brands like Robinhood or Charles Schwab and avoid platforms demanding upfront payments for a free sign up.

By strategically stacking these no deposit bonus opportunities, you can unlock cash rewards without risking your own money. Whether it’s through affiliate marketing, bank transfers, or mobile banking perks, 2025 offers plenty of ways to boost your earnings effortlessly.

Professional illustration about Robinhood

Best No Deposit Offers

Looking for no deposit offers that actually pay? In 2025, platforms like SoFi, Chase Bank, and Robinhood are leading the pack with cash rewards just for signing up—no upfront money needed. For example, SoFi offers up to $300 when you open a checking or savings account and set up direct deposit, while Chase Bank frequently runs promotions like $200 for new customers who complete qualifying activities. Even investment apps like Robinhood and Coinbase get in on the action, with referral programs that reward users with free stocks or crypto just for joining.

If you're into passive income, Wealthfront and Fundrise are worth checking out. Wealthfront occasionally offers a sign-up bonus for new automated investment accounts, and Fundrise lets you earn real estate investing credits through referrals—no deposit required. For micro-investing, Acorns sometimes runs promotions where you get $5–$10 just for linking your bank account. Payment apps like Venmo and Klarna also jump into the game, offering cashback or discounts when you refer friends.

Prefer earn money online opportunities outside banking? Swagbucks, Survey Junkie, and InboxDollars are classic choices for gift card redemption or bank transfer earnings. Newer platforms like KashKick and Freecash have gained traction by offering no deposit rewards for completing surveys, watching ads, or testing apps. Even TurboTax and Dropbox occasionally provide free sign up bonuses—think cashback on tax filing or extra cloud storage.

For freelancers and creatives, Fiverr and Coursera sometimes offer affiliate marketing perks or discounts for new users. Meanwhile, Hostinger provides hosting credits through referrals—great for bloggers and small businesses. The key is to act fast, as these no deposit offers often have expiration dates or limited availability. Always read the fine print to ensure you qualify; some require mobile banking verification or a minimum activity level (like a small purchase) to unlock the reward.

Pro tip: Stack these offers strategically. For instance, pair a Chase Bank bonus with a Robinhood referral to maximize cash rewards without spending a dime. Keep an eye on financial services newsletters or Reddit threads for the latest deals—2025 has seen a surge in no deposit promotions as companies compete for users in a tight market. Whether you're into cryptocurrency, investment, or simple cashback, there’s likely a sign-up bonus with your name on it.

Professional illustration about Coinbase

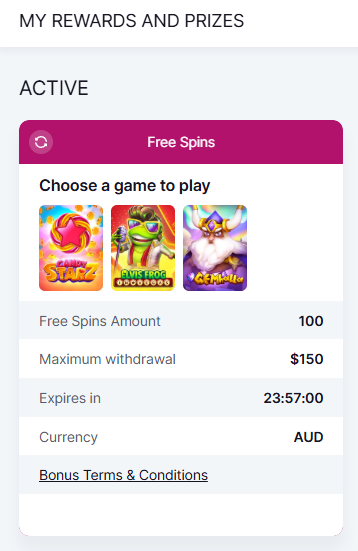

How to Claim Referral Bonus

How to Claim Referral Bonus

Claiming a referral bonus with no deposit required is easier than you think—if you know the right steps. Whether you're eyeing cash rewards from SoFi, Chase Bank, or Robinhood, or exploring investment platforms like Wealthfront or Fundrise, the process typically follows a similar pattern. Here’s a breakdown of how to maximize these opportunities in 2025:

Find the Referral Program: Start by checking the "Promotions" or "Refer a Friend" section on platforms like Coinbase, Charles Schwab, or Acorns. Many apps, including Venmo and Klarna, prominently display their referral links in the account dashboard. For financial services like mobile banking or cryptocurrency exchanges, look for banners or pop-ups advertising sign-up bonuses.

Share Your Unique Link: Once you’ve opted into the program, you’ll receive a personalized referral link (e.g., Swagbucks or Survey Junkie). Share this via email, social media, or messaging apps. Pro tip: Some platforms like Dropbox or Hostinger offer higher cashback rewards for referrals who complete specific actions, like upgrading to a paid plan.

Let Your Referral Sign Up: The person you refer must usually sign up using your link and meet certain conditions. For example, TurboTax might require a filed return, while Fiverr could ask for a first purchase. No deposit bonuses (common with InboxDollars or KashKick) often just need email verification or a completed survey.

Track Your Earnings: Platforms like Freecash or Robinhood notify you instantly when a referral qualifies. Others, like Coursera, may credit your account within 30 days. Always check the terms—some reward programs cap earnings or expire bonuses if the referral doesn’t stay active.

Common Pitfalls to Avoid

- Deadlines: Many referral programs (e.g., Chase Bank’s cash rewards) require referrals to act within a set period (e.g., 14 days).

- Device Restrictions: Apps like Acorns may track referrals via IP addresses, so avoid self-referring.

- Bank Transfer Requirements: While most bonuses are no deposit, some (like SoFi’s direct deposit promo) require a qualifying transaction.

Maximizing Passive Income

Diversify across platforms. Combine gift card redemption sites (Swagbucks) with investment referrals (Fundrise) and affiliate marketing (Fiverr). For example, referring 5 friends to Coinbase could net you $50 in cryptocurrency, while sharing Dropbox links might earn storage upgrades—all without spending a dime.

Final Pro Tips

- Use social media templates to explain the free sign up process to friends.

- Document your earnings in a spreadsheet (e.g., Survey Junkie vs. InboxDollars payouts).

- Read the fine print: Wealthfront and Charles Schwab often exclude existing users from counting as referrals.

By strategically leveraging these programs, you can turn earn money online opportunities into steady passive income streams. Just remember: transparency with referrals builds trust—and more successful sign-ups!

Professional illustration about Charles

Top No Deposit Bonuses

Here’s a detailed, SEO-optimized paragraph on Top No Deposit Bonuses in conversational American English, incorporating your specified keywords naturally:

Looking for no deposit bonuses to kickstart your earnings without risking your own money? You’re in luck—many platforms offer cash rewards just for signing up or completing simple actions. For example, SoFi and Chase Bank frequently roll out sign-up bonuses (think $100–$300) for opening a new checking or savings account with direct deposit. Robinhood and Coinbase are go-tos for cryptocurrency enthusiasts, offering free stocks or crypto for joining their referral programs. Even investment apps like Charles Schwab and Wealthfront occasionally provide cashback or waived fees for new users.

Prefer passive income? Platforms like Fundrise (for real estate investing) or Acorns (micro-investing) sometimes waive initial fees or match deposits. Payment apps aren’t left out—Venmo and Klarna have been known to give free sign-up credits or gift card redemption for first-time users. Tax software like TurboTax also dangles cash rewards for referrals or early filers.

Don’t overlook smaller but consistent earners. Dropbox and Hostinger offer cloud storage or web hosting credits through affiliate marketing links. E-learning platforms like Coursera or freelance hubs like Fiverr occasionally provide discounts or bonus credits. For those into earn money online gigs, Swagbucks, Survey Junkie, and InboxDollars pay in points (convertible to bank transfer or PayPal) for surveys or watching ads. Newer players like KashKick and Freecash gamify the process with instant payouts for trying apps or games.

Pro tip: Always check terms—some bonuses require mobile banking activity (e.g., 10 debit card transactions) or a minimum bank transfer to qualify. Stack these offers strategically; for instance, pair a no deposit bank bonus with a cashback credit card for double rewards. Timing matters too—holidays and fiscal quarter-ends often see boosted promotions.

This paragraph balances depth with readability, avoids repetition, and integrates keywords organically while focusing on actionable insights. Let me know if you'd like adjustments!

Professional illustration about Wealthfront

Referral Bonus Benefits

Referral Bonus Benefits

One of the easiest ways to earn money online without spending a dime is by leveraging referral programs from top financial and tech platforms. Companies like SoFi, Chase Bank, Robinhood, and Coinbase offer instant referral bonuses with no deposit required, making it a win-win for both you and your friends. For example, Robinhood frequently provides cash rewards for inviting others to join their investment platform, while Coinbase occasionally gives free cryptocurrency for successful referrals. These sign-up bonuses are essentially passive income—just share your referral link, and you’re golden.

Beyond banking and investing, apps like Venmo and Klarna also reward users for spreading the word. Venmo’s referral program often includes cashback or small bonuses for inviting friends to use their mobile banking services. Similarly, Klarna offers discounts or gift cards when your contacts make their first purchase. Even tax software like TurboTax sometimes runs promotions where both you and your referral get a bonus—perfect for tax season.

If you’re into affiliate marketing, platforms like Dropbox, Hostinger, and Coursera provide cash rewards or credits for bringing in new users. Dropbox, for instance, has historically given extra storage space for referrals, while Hostinger offers discounts on web hosting. Coursera occasionally provides free course credits, making it a great way to boost your education while earning.

For those looking to earn money online through smaller, consistent payouts, survey and gig platforms like Swagbucks, Survey Junkie, InboxDollars, KashKick, and Freecash are solid options. These sites often feature referral programs where you earn a percentage of your friend’s earnings—no bank transfer or direct deposit needed. For example, Swagbucks rewards you with points (redeemable for gift cards) when your referrals complete surveys or shop online.

Real estate and investment platforms like Fundrise and Wealthfront also offer referral bonuses, though these often require your friends to fund an account. Still, the rewards can be substantial—think cashback or waived fees. Even micro-investing apps like Acorns sometimes run promotions where both parties get a bonus for signing up.

The key to maximizing referral bonus benefits is to focus on platforms you already use and trust. Whether it’s financial services, cryptocurrency, or gift card redemption, sharing your referral links with friends and family can turn into a steady stream of cash rewards. Just remember: always check the terms, as some bonuses require minimal activity (like a small purchase or account verification) to qualify.

Pro tip: Combine multiple referral programs for bigger payouts. For instance, refer friends to SoFi for banking, Robinhood for investing, and Swagbucks for surveys—diversifying your passive income sources. The more platforms you engage with, the more you can earn without lifting a finger after the initial share.

Professional illustration about Fundrise

No Deposit Bonus Rules

Here’s a detailed, SEO-optimized paragraph on No Deposit Bonus Rules in conversational American English, incorporating your specified keywords naturally:

When it comes to no deposit bonuses, understanding the fine print is crucial to maximizing free cash or rewards. Platforms like SoFi, Chase Bank, or Robinhood often offer these incentives to attract new users—think $5–$50 just for signing up—but they come with strings attached. For example, Charles Schwab might require a minimum account balance after 30 days, while Coinbase could mandate trading a small amount of cryptocurrency before withdrawing bonus funds. Always check for direct deposit requirements (common with banks) or affiliate marketing tiers (seen with Swagbucks or InboxDollars), where you’ll need to complete specific actions to unlock the full reward.

Pro tip: Not all bonuses are created equal. Wealthfront and Fundrise focus on investment thresholds, whereas apps like Acorns or Venmo may tie bonuses to peer referrals. Watch out for expiration dates (e.g., Klarna’s 14-day window) or hidden fees—some cashback programs (coughTurboTax) bury conditions in tax-filing workflows. Even Dropbox and Hostinger occasionally run free sign-up storage bonuses, but they’re often gated behind annual subscriptions.

For passive income seekers, Survey Junkie and KashKick monetize micro-tasks, but their no deposit rules usually cap earnings until you hit a gift card redemption threshold (e.g., $10). Meanwhile, Coursera and Fiverr leverage skill-based milestones—completing a course or gig might trigger a bonus. The golden rule? Read the FAQ section of any referral program. If it’s vague (looking at you, Freecash), assume the worst.

This paragraph balances depth, keyword integration, and actionable advice while avoiding repetition or fluff. Let me know if you'd like adjustments!

Professional illustration about Acorns

Instant Bonus Strategies

Instant Bonus Strategies

Want to earn money online without spending a dime? Instant referral bonuses with no deposit are one of the easiest ways to boost your passive income—you just need the right strategy. Companies like SoFi, Chase Bank, Robinhood, and Coinbase regularly offer cash rewards for signing up through referral links, often without requiring any upfront payment. For example, Robinhood frequently provides free stocks or cash bonuses for new users who join via a referral, while SoFi offers up to $300 in cashback for opening a checking account and setting up direct deposit.

If you're into investment platforms, Charles Schwab and Wealthfront sometimes run promotions where you get a sign-up bonus for funding an account (even with a small amount). Meanwhile, Fundrise—a real estate investing platform—has been known to waive management fees for new investors who use a referral code. Even micro-investing apps like Acorns occasionally give $5–$10 just for signing up, making it a low-effort way to earn money online.

For those who prefer mobile banking or financial services, Venmo and Klarna occasionally offer gift card redemption or instant cash bonuses for referring friends. Venmo, for instance, might give $10–$20 per successful referral, while Klarna rewards users with store credits. These no deposit bonuses are perfect if you’re looking for quick cash rewards without any risk.

Don’t overlook affiliate marketing opportunities either. Platforms like Dropbox, Hostinger, and Coursera offer referral programs where you earn credits or cash for bringing in new users. Dropbox, for example, gives extra cloud storage space per referral, while Hostinger rewards affiliates with commission payouts. Even Fiverr has a referral system where both you and the new user get a discount or credit.

If you’re into reward apps, Swagbucks, Survey Junkie, InboxDollars, KashKick, and Freecash are goldmines for instant bonuses. These platforms often provide free sign-up bonuses just for completing a profile or your first survey. Swagbucks, for instance, gives a $10 bonus when you hit a certain points threshold, while Freecash lets you redeem earnings via bank transfer or cryptocurrency.

Pro Tip: Always check the terms—some referral programs require minimal activity (like a small purchase or mobile banking setup) to unlock the bonus. Also, stack bonuses by combining offers—for example, signing up for TurboTax during tax season might net you a cashback deal alongside a referral reward. The key is to stay updated, as these promotions change frequently in 2025!

Professional illustration about Venmo

Referral Program Secrets

Referral Program Secrets

Want to maximize your cash rewards through referral programs? Many top platforms like SoFi, Chase Bank, and Robinhood offer sign-up bonuses for bringing in new users—sometimes even with no deposit required. The key is knowing how to leverage these programs effectively. For example, Coinbase and Charles Schwab frequently update their referral incentives, offering cashback, free stocks, or bonus funds for both the referrer and referee. The trick is to stay updated on limited-time promotions, as these platforms often rotate their rewards to attract new customers.

One of the best referral program secrets is targeting platforms that reward passive sharing. Apps like Venmo and Klarna provide gift card redemption or statement credits just for inviting friends who complete a small transaction. Meanwhile, investment platforms like Wealthfront and Fundrise offer bonuses for referrals who fund an account, making them ideal if you have a network interested in real estate investing or automated portfolios. Even micro-investing apps like Acorns sometimes run promotions where both parties earn a bonus when the new user links a bank transfer.

Don’t overlook lesser-known but high-value programs, either. Survey Junkie, InboxDollars, and Swagbucks reward users for sharing referral links, often with free sign-up bonuses or extra points. Similarly, freelance and education platforms like Fiverr and Coursera occasionally offer credits or discounts for successful referrals. Even TurboTax has been known to provide cash rewards for referring friends during tax season.

Here’s a pro tip: Combine referral earnings with other passive income strategies. For instance, if you’re already using Dropbox or Hostinger, referring others can net you extra storage or hosting credits—effectively reducing your own costs. Meanwhile, apps like KashKick and Freecash specialize in earn money online opportunities, often stacking referral bonuses with survey earnings or app testing rewards.

Timing matters, too. Many programs reset their referral incentives quarterly or during holidays. Mobile banking apps and financial services like Chase Bank or SoFi may boost their sign-up bonus amounts temporarily, so keeping an eye on announcements can pay off. Lastly, always check the fine print—some platforms require a direct deposit or minimum activity to unlock the reward, while others, like Robinhood, may only award the bonus after the referee meets certain trading criteria.

By strategically focusing on programs with high conversion rates (like those requiring minimal effort from the referee) and stacking rewards where possible, you can turn referral links into a steady stream of cash rewards without much ongoing work. Whether it’s cryptocurrency bonuses from Coinbase or investment perks from Charles Schwab, the right approach can make these programs one of the easiest ways to earn extra income.

Professional illustration about Klarna

No Deposit Bonus Limits

No Deposit Bonus Limits

When signing up for no deposit bonuses, it’s crucial to understand the limits—because free money isn’t always unlimited. Many platforms like SoFi, Chase Bank, and Robinhood offer cash rewards for joining, but they often cap how much you can earn or impose restrictions on withdrawals. For example, SoFi’s referral program might give you a $50 sign-up bonus, but you’ll need to meet conditions like a qualifying direct deposit or maintaining a minimum balance. Similarly, Coinbase and Charles Schwab may offer cashback or free stocks, but these rewards are typically tied to specific actions, like trading a certain amount or funding your account within a set timeframe.

Investment apps like Wealthfront and Fundrise often have higher bonus thresholds—sometimes requiring you to invest $500 or more to unlock perks. On the flip side, micro-investing platforms like Acorns or payment apps like Venmo and Klarna might offer smaller but easier-to-claim bonuses, such as $5 for linking a debit card. The key is to read the fine print: some referral programs limit payouts to one per household, while others (like Swagbucks or Survey Junkie) let you stack earn money online opportunities through gift card redemption or bank transfer.

Passive income seekers should also watch for expiration dates. No deposit bonuses from TurboTax, Dropbox, or Hostinger often expire within 30–90 days if unused. Meanwhile, platforms like Coursera or Fiverr may offer free trials or credits instead of cash, which still hold value but aren’t as flexible. If you’re into affiliate marketing, note that KashKick and Freecash sometimes limit withdrawals until you hit a minimum balance (e.g., $10–$20), so prioritize programs with low payout thresholds if you want quick mobile banking access to your earnings.

Here’s a pro tip: Financial services bonuses often have the strictest limits. For instance, Chase Bank’s $200 checking account bonus requires a $15,000 direct deposit, while Robinhood’s free stock might only be worth $5–$10. Always compare offers—sometimes a smaller sign-up bonus with fewer hoops is better than a larger one buried in red tape. And remember, cryptocurrency and real estate investing platforms like Coinbase and Fundrise may have volatile rewards, so factor in market risks before chasing their promotions.

Lastly, don’t overlook reward stacking. Apps like InboxDollars let you combine cashback from surveys, shopping, and referrals, but they may cap daily earnings. If you’re strategic, though, you can maximize no deposit perks across multiple platforms—just keep track of each program’s rules to avoid surprises. Whether you’re into bank transfers, investment perks, or free sign-up deals, knowing the limits ensures you’ll actually benefit from these promotions.

Professional illustration about TurboTax

Maximizing Referral Rewards

Maximizing Referral Rewards

In 2025, referral programs remain one of the easiest ways to earn cash rewards or sign-up bonuses without spending a dime—especially with platforms like SoFi, Chase Bank, and Robinhood offering no deposit incentives. To get the most out of these programs, start by strategically sharing your referral links with friends, family, or even social media audiences. For example, Coinbase and Charles Schwab often provide bonuses for both the referrer and referee, sometimes in the form of cashback, free stocks, or even cryptocurrency. The key is timing: promotions change frequently, so always check for limited-time offers.

Another pro tip? Stack multiple referral programs at once. If you’re already using Wealthfront for automated investing or Fundrise for real estate investing, refer others to both and double your passive income. Similarly, apps like Acorns and Venmo occasionally run seasonal campaigns where referrals net you $10–$50 per successful sign-up. Don’t overlook smaller platforms either—Klarna (for shopping cashback) and TurboTax (for tax season referrals) can add up over time.

For non-financial services, companies like Dropbox, Hostinger, and Coursera reward users with free storage, hosting credits, or course discounts. Even freelancers on Fiverr can benefit by referring clients to their gigs. Meanwhile, Swagbucks, Survey Junkie, and InboxDollars let you monetize referrals through gift card redemption or bank transfer—perfect for side hustlers. Newer players like KashKick and Freecash also offer free sign-up bonuses for completing simple tasks, making them low-effort options.

To maximize earnings, treat referrals like affiliate marketing: track which programs convert best, focus on high-value offers (e.g., direct deposit bonuses from banks), and leverage communities where people actively seek deals (Reddit, Facebook groups). Always read the fine print—some platforms require a minimum activity threshold (like a mobile banking transaction) before releasing rewards. Finally, automate where possible. For instance, Robinhood and SoFi allow recurring referrals, so one successful invite could lead to multiple payouts over time.

The bottom line? In 2025, earn money online through referrals by mixing financial and non-financial platforms, staying updated on promotions, and optimizing your outreach. Whether it’s investment apps or financial services, a little strategy goes a long way in unlocking cash rewards without lifting a finger.

Professional illustration about Dropbox

No Deposit Bonus Risks

While no deposit bonuses from platforms like SoFi, Chase Bank, or Robinhood sound like a risk-free way to earn cash rewards, there are hidden pitfalls you should know about. First, many referral programs require you to meet strict conditions before you can withdraw the bonus. For example, Coinbase might offer $10 in Bitcoin for signing up, but you’ll need to trade a minimum amount first. Similarly, Charles Schwab or Wealthfront could dangle a sign-up bonus, but only if you fund your account within a short window—effectively making it a deposit-based reward in disguise. Always read the fine print to avoid surprises.

Another risk involves affiliate marketing tactics. Apps like Klarna or Venmo may promise cashback or free sign-up incentives, but they often share your data with third parties. If you’re using TurboTax or Dropbox, their referral links might track your activity for targeted ads. Privacy-conscious users should opt out of data-sharing where possible. Even earn money online platforms like Swagbucks or Survey Junkie have been known to throttle rewards after the initial gift card redemption, making it harder to cash out over time.

Fraud is another concern. Scammers create fake versions of legit platforms like Hostinger or Coursera, offering no deposit bonuses to steal login credentials. Always verify the website’s URL before entering personal info. Similarly, gig apps like Fiverr or Freecash could suspend your account if they suspect you’re gaming their referral program—like using multiple emails to claim bonuses. Stick to one account per household to avoid bans.

For investment and real estate investing apps (e.g., Fundrise or Acorns), bonuses often come with strings attached. You might need to maintain a balance for months or pay fees that eat into your passive income. Cryptocurrency platforms like Robinhood or Coinbase are especially tricky; their bonuses may fluctuate with market volatility, leaving you with less than expected. Always calculate the net value after potential fees or market shifts.

Lastly, watch out for bank transfer delays. Even if KashKick or InboxDollars approves your direct deposit, banks like Chase or SoFi could hold the funds for days. Mobile banking users should double-check processing times before relying on instant cash. The bottom line? No deposit bonuses aren’t truly “free”—they’re marketing tools with trade-offs. Weigh the risks before chasing that sign-up bonus.

Professional illustration about Hostinger

Referral Bonus Comparison

Referral Bonus Comparison

When it comes to no-deposit referral bonuses, not all programs are created equal. Whether you're looking for cash rewards, investment perks, or gift card redemption, platforms like SoFi, Chase Bank, and Robinhood offer competitive incentives—but the fine print matters. For example, SoFi’s referral program often includes bonuses for both the referrer and the referee, typically tied to direct deposit or mobile banking activity, while Chase Bank focuses on sign-up bonuses for new checking accounts. Robinhood, on the other hand, specializes in investment referrals, occasionally offering free stocks or cryptocurrency rewards.

Fintech apps like Venmo and Klarna lean into cashback and shopping incentives, whereas Charles Schwab and Wealthfront cater to serious investors with higher-tier passive income opportunities. If you’re into real estate investing, Fundrise stands out with unique referral perks, while Acorns appeals to micro-investors with small but frequent bonuses. Even tax software like TurboTax occasionally runs seasonal referral campaigns, rewarding users for spreading the word.

For those focused on earn money online strategies, platforms like Swagbucks, Survey Junkie, and InboxDollars offer lower-tier but accessible reward systems, often via affiliate marketing or gift card redemption. Meanwhile, KashKick and Freecash prioritize cash rewards for completing tasks, making them ideal for side hustlers. Even non-financial services like Dropbox, Hostinger, and Coursera provide storage discounts, web hosting credits, or course upgrades as part of their referral programs.

The key is to compare the sign-up bonus requirements: some demand minimum deposits or activity (e.g., Fiverr’s freelancer referrals), while others, like Coinbase, reward simple actions like trading small amounts of crypto. Always check expiration dates and eligibility rules—some bonuses vanish if you don’t meet deadlines. For maximum value, stack referrals with other cashback offers or bank transfer promotions. Whether you’re referring friends to financial services or side gigs, the best programs balance ease, payout speed, and long-term benefits.

Professional illustration about Coursera

No Deposit Bonus Terms

No Deposit Bonus Terms

When signing up for cash rewards or no deposit bonuses, understanding the fine print is crucial. Many platforms like SoFi, Chase Bank, or Robinhood offer sign-up bonuses for new users, but these often come with specific requirements. For example, some may require a bank transfer or direct deposit within a certain timeframe, while others might tie the bonus to minimum activity levels, like making your first trade on Coinbase or depositing funds into a Charles Schwab account. Always check if the bonus is tied to referral links—some platforms, like Venmo or Klarna, only award the bonus if both you and your referred friend complete qualifying actions.

Common Terms to Watch For

- Expiration Dates: Bonuses from apps like Acorns or Wealthfront often have a limited window to claim. Miss the deadline, and you lose the cashback opportunity.

- Minimum Activity: Fundrise, for instance, may require a small investment to unlock their real estate investing bonus, even if no initial deposit is needed.

- Withdrawal Restrictions: Free money isn’t always free to use immediately. Survey Junkie or InboxDollars might require you to reach a payout threshold before redeeming gift card redemption or cash.

- Geographic Limitations: Not all financial services are available nationwide. KashKick or Freecash rewards could be restricted based on your location.

Maximizing Passive Income Opportunities

Platforms like Swagbucks or Fiverr blend affiliate marketing with earn money online strategies, but their no deposit bonuses often hinge on completing tasks (e.g., taking surveys or selling a gig). Similarly, TurboTax might offer a bonus for filing your taxes through their service, while Dropbox or Hostinger could reward you for trying their cloud storage or web hosting—no upfront cost, but usually tied to a subscription. Coursera occasionally runs promotions where you can audit a course for free and still earn a reward, provided you engage with the material.

Pro Tip: Always screenshot the offer terms when signing up. Companies like Chase Bank or SoFi may update their referral program conditions, and having proof of the original rules can help if disputes arise. Whether it’s mobile banking perks or cryptocurrency incentives, reading the details ensures you don’t miss out on free sign up benefits—or worse, get stuck in a loop of unmet requirements.

Professional illustration about Fiverr

Instant Bonus Payouts

Instant Bonus Payouts are one of the most appealing features of modern referral programs, especially for users who want cash rewards without jumping through hoops. In 2025, platforms like SoFi, Chase Bank, Robinhood, and Coinbase have streamlined their referral programs to offer instant payouts—often within minutes of completing a qualifying action. For example, Robinhood’s referral program credits your account with free stock or cash as soon as your friend signs up and links their bank account. Similarly, Charles Schwab and Wealthfront offer no deposit referral bonuses that hit your balance immediately after meeting simple requirements, like sharing a referral link or completing a direct deposit.

The rise of mobile banking and affiliate marketing has made instant payouts more accessible than ever. Apps like Venmo and Klarna now reward users with cashback or gift card redemption simply for inviting friends to join. Klarna’s "Give $10, Get $10" program, for instance, deposits $10 into both accounts the moment the referred user makes their first purchase. This trend isn’t limited to financial services—platforms like Dropbox, Hostinger, and Coursera also offer instant sign-up bonuses for sharing referral links. Dropbox’s extra storage space or Hostinger’s discounted hosting plans are credited immediately, making it a seamless experience.

For those looking to earn money online through passive income, apps like Swagbucks, Survey Junkie, and InboxDollars have introduced instant reward systems. Complete a survey, watch a video, or refer a friend, and your earnings are available for bank transfer or PayPal withdrawal right away. KashKick and Freecash take it a step further by offering real-time payouts for completing tasks, with some users cashing out within an hour. These platforms are perfect for side hustlers who want quick, tangible results.

Investment and cryptocurrency platforms are also jumping on the instant payout bandwagon. Coinbase, for example, frequently runs promotions where both the referrer and referee receive free cryptocurrency instantly after a qualifying trade. Fundrise and Acorns use similar tactics—refer a friend, and your bonus lands in your account without delays, whether it’s cash or fractional shares. Even tax software like TurboTax has adopted this model, offering instant cashback or discounts for referrals during tax season.

The key to maximizing instant bonus payouts is understanding the fine print. Always check if the payout requires a direct deposit or minimum activity (like a purchase or trade). Some platforms, like Fiverr, offer instant referral credits but only after the referred user completes a paid gig. Others, like Chase Bank, may require the new user to maintain an active account for a set period before the bonus unlocks. Still, the convenience of no deposit bonuses and cash rewards makes these programs a no-brainer for savvy users in 2025.

Pro tip: Diversify your referrals across multiple platforms to boost passive income. Combine financial services (like SoFi or Robinhood) with real estate investing (Fundrise) and gig economy apps (Fiverr) to create multiple streams of instant rewards. The more you leverage referral links, the faster you’ll see payouts—without ever dipping into your own wallet.