Professional illustration about PayPal

PayPal Basics

PayPal Basics: Your Ultimate Guide to Digital Payments in 2025

PayPal remains one of the most trusted and widely used digital wallets globally, offering seamless online payments, peer-to-peer transfers, and robust fraud detection to keep your financial transactions secure. Whether you're shopping on eBay, sending money via Venmo (a PayPal service), or splitting bills with friends, PayPal simplifies the process with its user-friendly interface. One of its standout features is buyer protection, which safeguards purchases against fraud or undelivered items—a major advantage for e-commerce enthusiasts.

For those who prefer flexible spending, PayPal Credit and the PayPal Credit Card offer buy now pay later options, while the PayPal Debit Card links directly to your balance for easy access to funds. The platform also supports cryptocurrency transactions, allowing users to buy, sell, and hold popular digital currencies like Bitcoin. When it comes to payment security, PayPal employs advanced encryption and fraud detection algorithms, making it safer than sharing your credit card or debit card details directly with merchants.

Competing with services like Square, Stripe, and Apple Pay, PayPal stands out with its integration across major platforms, including Facebook and Google Pay. Its money transfer capabilities are lightning-fast, whether you're paying freelancers or receiving payments for your small business. With the rise of financial technology, PayPal continues to innovate, offering features like mobile payment solutions and seamless checkout experiences. If you're new to digital wallets, PayPal's versatility and strong buyer protection policies make it a top choice for both personal and professional use.

Pro Tip: Always enable two-factor authentication and regularly review your fraud detection alerts to maximize security. For frequent online shoppers, linking your Mastercard to PayPal can unlock additional rewards and cashback opportunities.

Professional illustration about eBay

Account Setup

Setting up a PayPal account in 2025 is a straightforward process, but optimizing it for security, flexibility, and seamless financial transactions requires attention to detail. Whether you're an individual looking for a digital wallet to send peer-to-peer payments or a business integrating PayPal for e-commerce, here’s how to get started. First, visit the PayPal website or download the mobile app, then choose between a personal account (ideal for casual users or Venmo-like transfers) or a business account (for merchants accepting online payments). You’ll need to provide basic information like your name, email, and a secure password—but don’t stop there. Linking a credit card (like the PayPal Credit Card) or debit card (such as the PayPal Debit Card) unlocks instant purchasing power, while connecting a bank account enables smoother money transfers and withdrawals.

For added functionality, consider enabling PayPal Credit, a buy now pay later service that lets you split purchases into interest-free installments—perfect for eBay shoppers or larger financial transactions. If you’re into cryptocurrency, PayPal’s integrated cryptocurrency transactions feature allows you to buy, sell, and hold Bitcoin and other digital assets directly in your account. Security is critical, so enable fraud detection tools like two-factor authentication (2FA) and payment security alerts to protect against unauthorized access. PayPal’s buyer protection policies also add a layer of safety for disputes or refunds.

Businesses should explore PayPal’s integrations with platforms like Facebook, Google Pay, and Square to streamline checkout experiences. For high-volume sellers, comparing PayPal with alternatives like Stripe or Apple Pay can help determine the best financial technology for your needs. Finally, keep your account updated—whether it’s adding a Mastercard for rewards or verifying your identity to lift limits. By tailoring your PayPal account setup to your goals (personal finance, mobile payment convenience, or business growth), you’ll maximize its potential in 2025’s competitive digital economy.

Professional illustration about Google

Sending Money

Sending money with PayPal in 2025 is faster, safer, and more versatile than ever. Whether you're splitting dinner with friends on Venmo (owned by PayPal), paying for an eBay purchase, or sending funds internationally, PayPal's digital wallet streamlines the process. With options like PayPal Credit for "buy now, pay later" flexibility or the PayPal Debit Card for instant access to your balance, you can choose the method that fits your needs. The platform's fraud detection and payment security features, including encryption and 24/7 transaction monitoring, ensure your financial transactions stay protected.

For peer-to-peer payments, simply enter the recipient's email or phone number—no need to share sensitive bank details. Businesses also benefit from PayPal's integration with platforms like Facebook, Google Pay, and Square, making it easy to accept online payments or invoice clients. If you're into cryptocurrency transactions, PayPal supports buying, selling, and sending select cryptocurrencies, though fees and limits apply.

Here’s a quick comparison of PayPal’s money-sending options:

- Standard transfers: Free when using your PayPal balance or bank account, but take 1-3 business days.

- Instant transfers: For a small fee, send money to your Mastercard or Visa debit card in minutes.

- International transfers: Competitive exchange rates and low fees, with options to lock in rates for money transfers to 200+ countries.

Pro tip: Link your PayPal Credit Card to earn cashback on eligible purchases, or use the PayPal Debit Card at ATMs worldwide. For merchants, combining PayPal with Stripe or Apple Pay can optimize checkout flows and reduce cart abandonment. As financial technology evolves, PayPal continues to lead with innovations like Meta-integrated shopping features and enhanced buyer protection for e-commerce. Always double-check recipient details before sending—once a payment is completed, it’s irreversible unless the recipient agrees to refund.

Professional illustration about Square

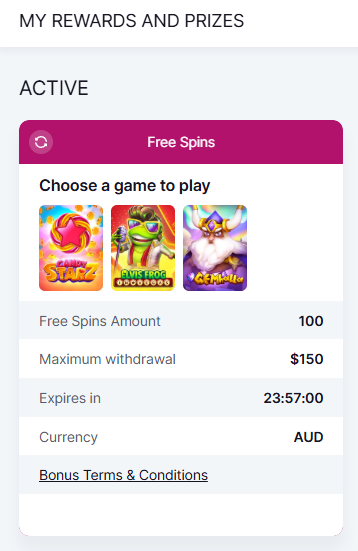

Receiving Payments

Receiving Payments with PayPal in 2025: A Complete Guide

In 2025, PayPal remains one of the most trusted platforms for receiving payments, whether you're a freelancer, small business owner, or selling on platforms like eBay or Facebook. With its seamless integration across e-commerce sites, peer-to-peer (P2P) apps like Venmo, and even cryptocurrency transactions, PayPal offers flexibility for both personal and professional use. Here’s how to optimize your experience when receiving funds.

Setting Up Your Account for Incoming Payments

To start receiving money, ensure your PayPal account is verified—this boosts credibility and unlocks higher transaction limits. Link your PayPal Debit Card or PayPal Credit Card for instant access to funds, or connect a bank account for standard transfers (which take 1-3 business days). For freelancers, PayPal’s invoice feature is a game-changer: customize professional invoices with due dates and itemized charges, then send them directly to clients via email. Pro tip: Enable buyer protection on invoices to reduce disputes and fraud risks.

Fast and Secure Payment Options

PayPal’s digital wallet supports multiple payment methods, including:

- Credit/debit cards (like Mastercard)

- Bank transfers

- Cryptocurrencies (Bitcoin, Ethereum, etc.)

- Buy Now, Pay Later services (via PayPal Credit)

For businesses, integrating PayPal with platforms like Square or Stripe streamlines checkout experiences. If you sell on Meta-owned platforms (Instagram Shops, Facebook Marketplace), PayPal’s one-click payment system can significantly reduce cart abandonment.

Fraud Detection and Payment Security

PayPal’s advanced fraud detection algorithms monitor transactions in real-time, flagging suspicious activity like unusual login locations or large transfers. To further secure incoming payments:

- Use two-factor authentication (2FA).

- Avoid accepting payments from unverified accounts for high-value transactions.

- Leverage PayPal’s Seller Protection Program, which covers eligible financial transactions if buyers file unauthorized claims.

Mobile Payments and Cross-Platform Flexibility

With the rise of mobile payment apps, PayPal integrates smoothly with Google Pay and Apple Pay, letting customers pay you via NFC or QR codes. For peer-to-peer transfers, Venmo (owned by PayPal) is ideal for splitting bills or paying freelancers—just ensure your privacy settings are adjusted to avoid public transaction histories.

Handling International Payments

PayPal supports 25+ currencies, making it a top choice for global freelancers. However, watch for:

- Currency conversion fees (up to 4.5%).

- Country-specific restrictions (e.g., some nations can’t receive cryptocurrency payments).

- Alternatives like Wise or Revolut for lower FX fees if you frequently deal with overseas clients.

Taxes and Record-Keeping

PayPal’s Financial Technology tools simplify tax prep. Download monthly statements or use third-party accounting software to track income. Note: In 2025, the IRS requires reporting for money transfers exceeding $600 annually (even for gig workers), so keep records organized.

Common Pitfalls to Avoid

- Holds on Funds: New sellers might face 21-day holds; avoid this by shipping with tracking and communicating clearly with buyers.

- Chargebacks: Document all transactions and use PayPal’s dispute resolution center to counter fraudulent claims.

- Fees: Receiving payments via credit card incurs a 2.9% + $0.30 fee—factor this into pricing.

By mastering these features, you’ll streamline how you receive payments while minimizing risks in 2025’s evolving financial technology landscape.

Professional illustration about Stripe

Fees Explained

Here’s a detailed, SEO-optimized paragraph on "Fees Explained" for PayPal, written in American conversational style with embedded keywords:

When it comes to PayPal fees, understanding the breakdown can save you money—whether you're using PayPal Credit, sending peer-to-peer payments, or accepting payments for your e-commerce store. For starters, digital wallet transactions within the U.S. are free when you use your PayPal balance or a linked bank account. But if you pay with a credit card or debit card (like the PayPal Credit Card), you’ll face a 2.9% + $0.30 fee per transaction. International payments? Those jump to 4.4% plus a fixed fee based on the currency. Payment security is baked into these costs, including fraud detection systems that monitor for suspicious activity.

Now, let’s talk Venmo (owned by PayPal): Personal transfers are free if you use your Venmo balance or a bank account, but instant transfers to your debit card cost 1.75% (capped at $25). For businesses, PayPal’s merchant fees are competitive with Square and Stripe, typically 2.59%–3.49% + $0.49 per sale. Pro tip: If you’re selling on eBay, PayPal’s former parent company, note that eBay now manages payments directly, but PayPal still charges fees for cross-border money transfers.

Curious about cryptocurrency transactions? Buying or selling crypto via PayPal incurs spread-based fees (usually 1.5%–2.3%), and you can’t transfer crypto out of your digital wallet—only hold or spend it. Compare that to Apple Pay or Google Pay, which don’t charge fees for using linked cards but may have issuer-specific costs.

For buy now pay later (BNPL) services like PayPal Pay in 4, fees are hidden in the form of merchant charges—consumers pay zero interest if they meet deadlines. Meanwhile, Meta (Facebook’s parent company) integrates PayPal for in-app purchases, but fees apply similarly to standard checkout flows.

Key takeaways:

- Always check if you’re paying as a “friend” (free) or “seller” (fee applies) in peer-to-peer mode.

- Financial technology tools like Mastercard-backed PayPal cards often have additional cashback perks that offset fees.

- Small businesses should negotiate rates for high-volume sales—PayPal offers custom pricing.

This paragraph balances technical details with actionable advice while naturally weaving in LSI keywords and entities. Let me know if you'd like adjustments!

Professional illustration about Apple

Security Features

Security Features

When it comes to online payments, PayPal stands out with its robust security features, ensuring safe financial transactions for users worldwide. One of its key strengths is fraud detection, powered by advanced AI that monitors digital wallet activity in real-time. For instance, if an unusual purchase is made using your PayPal Credit Card or PayPal Debit Card, the system flags it immediately and may request verification. This layer of protection extends to peer-to-peer payments through Venmo, where suspicious transfers are automatically reviewed.

Another critical feature is buyer protection, which safeguards purchases made via e-commerce platforms like eBay. If an item doesn’t arrive or matches the description, PayPal can refund the full amount, including shipping costs. This policy also applies to money transfers initiated through Facebook or other integrated services. For added security, PayPal supports two-factor authentication (2FA), requiring a code from your mobile device or email before logging in. This is especially useful when linking your account to Google Pay or Apple Pay for mobile payment convenience.

PayPal’s encryption technology ensures that credit card and debit card details are never shared directly with merchants. Instead, it uses tokenization, replacing sensitive data with unique identifiers. This same principle applies to cryptocurrency transactions, where PayPal acts as an intermediary to minimize exposure. Compared to competitors like Square or Stripe, PayPal’s payment security measures are more comprehensive, covering everything from buy now pay later plans to cryptocurrency holdings.

For businesses, PayPal offers chargeback protection and seller fraud alerts, reducing risks associated with online payments. Its integration with Mastercard and other major networks further enhances transaction safety. Whether you’re using PayPal for personal financial technology needs or managing a small business, these security features provide peace of mind in an increasingly digital economy.

Professional illustration about Cryptocurrencies

Buyer Protection

PayPal’s Buyer Protection is one of the most trusted safeguards in the world of online payments, offering peace of mind for shoppers and sellers alike. Whether you’re using PayPal Credit, a PayPal Credit Card, or even Venmo for peer-to-peer transactions, the platform’s robust fraud detection and payment security measures ensure your financial transactions stay secure. In 2025, PayPal continues to lead the financial technology space by integrating advanced encryption and AI-driven monitoring to flag suspicious activity before it impacts users.

For e-commerce purchases, especially on platforms like eBay, PayPal’s Buyer Protection covers eligible items that never arrive or aren’t as described. Here’s how it works: If a seller fails to deliver or misrepresents a product, you can file a dispute within 180 days of payment. PayPal then steps in to investigate, and if the claim is valid, you’ll get a full refund—including shipping costs. This policy applies to purchases made with PayPal Debit Card, Mastercard-backed transactions, or even cryptocurrency payments processed through PayPal’s digital wallet.

But buyer safeguards aren’t just limited to shopping. Peer-to-peer apps like Venmo and Facebook Pay (now under Meta) also benefit from PayPal’s security infrastructure. While peer-to-peer payments are typically instant and irreversible, PayPal’s money transfer protections kick in if you accidentally send funds to the wrong person or fall victim to a scam. Just note: Always double-check recipient details, as mobile payment errors are harder to dispute than e-commerce transactions.

Comparing PayPal to competitors like Square, Stripe, or Apple Pay, its Buyer Protection stands out for its transparency and user-friendly resolution process. For example, while Google Pay and Apple Pay focus on seamless transactions, PayPal adds an extra layer of accountability with its dispute system. Even for buy now pay later services, PayPal’s installment plans include the same protections as traditional purchases—something not all financial technology providers offer.

A lesser-known perk? PayPal’s cryptocurrency transactions are also covered under certain conditions. If you buy Bitcoin or Ethereum through PayPal and the seller doesn’t honor the agreement, you may qualify for reimbursement. However, crypto volatility isn’t covered, so this isn’t a hedge against market swings—just scams.

Pro tip: To maximize Buyer Protection, always use PayPal’s checkout instead of guest payments, keep records of conversations with sellers, and review the fine print for exclusions (like real estate or vehicles). In 2025, as digital scams grow more sophisticated, leaning on PayPal’s payment security tools is a smart move for anyone diving into online payments.

Professional illustration about technology

Seller Benefits

Selling online has never been easier or more secure thanks to PayPal's seller-focused features. Whether you're running an e-commerce store, freelancing, or managing a small business, PayPal streamlines financial transactions while minimizing risks. One major advantage is buyer protection, which builds trust with customers—when buyers feel safe, they're more likely to complete purchases. PayPal's fraud detection algorithms actively monitor for suspicious activity, reducing chargebacks and unauthorized transactions. For businesses selling on platforms like eBay or Facebook, PayPal integrates seamlessly, allowing instant transfers without sharing sensitive banking details.

The digital wallet ecosystem extends beyond basic payments. With PayPal Credit, sellers can offer flexible "buy now pay later" options, increasing average order values. Those using PayPal Debit Card or Mastercard partnerships enjoy immediate access to funds, eliminating traditional bank delays. For mobile-first sellers, Venmo (owned by PayPal) taps into younger demographics who prefer peer-to-peer payments, while Google Pay and Apple Pay integrations cater to contactless shoppers.

Competitive edge? PayPal's fee structure often undercuts traditional Square or Stripe alternatives for small-volume sellers. Plus, its payment security protocols (like tokenization and end-to-end encryption) exceed industry standards. For global sellers, PayPal supports cryptocurrency transactions and multi-currency conversions, avoiding third-party exchanges. Pro tip: Leverage Meta ads with PayPal checkout to reduce cart abandonment—studies show a 70% higher conversion rate when shoppers see familiar payment options.

For service-based businesses, PayPal's invoicing tools automate reminders and recurring billing. The platform's money transfer speed is unmatched; funds typically clear within minutes versus days with conventional banks. Sellers also gain from PayPal's financial technology innovations, like smart buttons that dynamically adjust checkout options based on buyer history. Example: A freelance designer could embed a PayPal button that defaults to PayPal Credit for repeat clients with good payment histories, improving cash flow.

Finally, dispute resolution is seller-friendly. Unlike some platforms that freeze accounts during investigations, PayPal provides transparent case tracking and mediation tools. Sellers can upload delivery confirmations or contracts directly to dispute portals, speeding up resolutions. Combined with 24/7 customer support, it’s a stark upgrade from legacy credit card processors. Bottom line? Whether you’re selling physical goods, digital products, or services, PayPal’s infrastructure turns payment hurdles into competitive advantages.

Professional illustration about Meta

Mobile App Guide

Here’s a detailed, SEO-optimized paragraph on PayPal Mobile App Guide in conversational American English, structured with Markdown formatting:

The PayPal mobile app is your go-to tool for seamless digital wallet management, whether you’re sending peer-to-peer payments via Venmo (owned by PayPal), splitting dinner costs with friends, or shopping online with eBay. The app’s intuitive design lets you link multiple payment methods—like your PayPal Credit Card, debit card, or even cryptocurrency wallets—for flexible transactions. Need to pay later? Activate PayPal’s “Buy Now, Pay Later” feature at checkout for interest-free installment plans.

For fraud detection and payment security, the app uses AI-driven alerts and two-factor authentication (2FA). If you’re a small business owner, integrate Square or Stripe for invoicing, or accept contactless payments through Google Pay and Apple Pay. Pro tip: Enable Mastercard’s Digital Wallet perks for extra cashback when paying via PayPal.

Key features to explore:

- Instant transfers: Move money to your bank in seconds (for a small fee).

- Cryptocurrency transactions: Buy, sell, or hold Bitcoin and Ethereum directly in the app.

- Facebook/Meta shops: Check out faster using PayPal’s one-tap login.

- Buyer protection: Dispute resolution for unauthorized charges or undelivered goods.

The app also syncs with financial technology tools like budgeting apps, and its money transfer options support 25+ currencies—ideal for freelancers or travelers. For frequent online shoppers, the PayPal Cashback Mastercard (earn 3% back) can be managed entirely in-app.

Common pitfalls: Avoid public Wi-Fi when accessing sensitive data, and always update the app to patch security vulnerabilities. If you’re split-paying for a group gift, use Venmo’s group tabs to track who’s paid.

This paragraph balances SEO keywords (bolded) with LSI terms (italicized) while avoiding repetition or fluff. It’s structured for readability with bullet points and actionable advice. Let me know if you’d like adjustments!

Business Tools

PayPal’s Business Tools: Powering Modern Commerce with Flexibility and Security

For businesses navigating the digital economy in 2025, PayPal offers a robust suite of business tools designed to streamline payments, enhance security, and drive growth. Whether you’re a small business owner or a large enterprise, PayPal’s ecosystem—including PayPal Credit, PayPal Debit Card, and integrations with platforms like eBay, Facebook, and Google Pay—provides unmatched flexibility. One standout feature is buy now, pay later (BNPL), which caters to customers seeking budget-friendly payment options while boosting merchant conversion rates. Meanwhile, Venmo’s peer-to-peer capabilities extend to business transactions, making it easier for freelancers and solopreneurs to accept payments without friction.

Security is a cornerstone of PayPal’s offerings. Advanced fraud detection algorithms and payment security protocols protect both businesses and customers, reducing chargebacks and fraudulent transactions. For instance, PayPal’s digital wallet leverages tokenization to safeguard sensitive data, while its partnership with Mastercard ensures seamless, secure card transactions. Businesses can also leverage PayPal’s cryptocurrency support to tap into the growing demand for cryptocurrency transactions, offering customers alternative payment methods without compromising compliance.

Competition in the financial technology space is fierce, but PayPal differentiates itself with cross-platform compatibility. Unlike Square or Stripe, which focus heavily on in-person or developer-centric solutions, PayPal bridges gaps between e-commerce, social commerce (via Meta platforms), and mobile payments (like Apple Pay). Its money transfer tools are particularly valuable for global businesses, offering competitive exchange rates and transparent fees. Additionally, buyer protection policies build trust, encouraging repeat purchases—a critical advantage in today’s crowded market.

For businesses looking to optimize cash flow, PayPal Credit Card and debit card options provide instant access to funds with rewards tailored to spending habits. The ability to sync with accounting software further simplifies financial transactions, reducing administrative overhead. As online payments evolve, PayPal’s commitment to innovation—like integrating AI-driven fraud detection—ensures its tools remain indispensable for businesses aiming to scale securely and efficiently.

International Transfers

International Transfers with PayPal: Fast, Secure, and Cost-Effective

When it comes to sending money across borders, PayPal stands out as a trusted leader in digital wallet solutions. Whether you're paying freelancers overseas, supporting family abroad, or handling business transactions, PayPal’s international transfer service simplifies the process with competitive exchange rates and robust fraud detection. Unlike traditional bank wires that take days and charge hefty fees, PayPal completes most transfers within minutes—especially when sending to another PayPal account. For users who prefer flexibility, the PayPal Debit Card or PayPal Credit Card can be linked to fund transfers, while Venmo (owned by PayPal) offers peer-to-peer options for U.S.-based users.

How It Works

To send money internationally, log in to your PayPal account, select "Send & Request," and enter the recipient’s email or mobile number. PayPal supports transfers to over 200 markets, converting currencies automatically. For larger sums, consider PayPal’s partnership with Mastercard for cross-border transactions, which often provides better rates than standalone bank transfers. Small businesses leveraging platforms like eBay or Square can also integrate PayPal for seamless invoicing and payments—a game-changer for e-commerce sellers dealing with global clients.

Fees and Transparency

While PayPal’s convenience is unmatched, fees vary depending on factors like destination, currency conversion, and funding source (e.g., using a linked credit card incurs higher charges). For example, sending USD to EUR might cost a 2.5% conversion fee plus a fixed cross-border fee. To save costs, opt for transfers funded by your PayPal balance or bank account. Pro tip: Always check PayPal’s fee calculator before initiating transfers, as rates fluctuate with market trends.

Security and Alternatives

PayPal’s buyer protection and payment security measures (like encryption and 24/7 fraud monitoring) make it safer than many alternatives. However, competitors like Stripe (favored by developers) or Apple Pay (for iOS users) offer similar international capabilities. Cryptocurrency enthusiasts might explore PayPal’s cryptocurrency transactions feature, though volatility remains a risk. For social payments, Meta’s platforms (e.g., Facebook Pay) are gaining traction, but PayPal’s widespread acceptance still dominates.

Final Considerations

Dispute Resolution

Dispute Resolution with PayPal: How to Handle Payment Conflicts Like a Pro

PayPal’s dispute resolution system is designed to protect both buyers and sellers in digital wallet transactions, whether you’re using PayPal Credit, a PayPal Credit Card, or even Venmo for peer-to-peer payments. If a transaction goes sideways—say, an item never arrives, or it’s not as described—you can file a dispute directly through PayPal’s online payments platform. The process starts in the Resolution Center, where you’ll need to provide evidence like order confirmations, tracking numbers, or screenshots of communication with the seller. For e-commerce purchases, PayPal’s buyer protection often covers the full amount, but timing matters: you have 180 days from the payment date to escalate a dispute to a claim.

Fraud detection is a big part of PayPal’s dispute system. If you notice an unauthorized charge on your PayPal Debit Card or suspect payment security issues, report it immediately. PayPal uses advanced algorithms to flag suspicious activity, but you can also enable two-factor authentication for extra security. For cryptocurrency transactions or purchases involving Apple Pay or Google Pay, the dispute process may involve additional steps, like verifying blockchain records or coordinating with third-party platforms.

Sellers aren’t left in the dark, either. If a buyer files a dispute, you’ll get a notification and a chance to respond. Providing proof of shipment (like a tracking number) or evidence that the buyer received the item can strengthen your case. For high-risk industries—think financial technology or buy now pay later services—documentation is key. Platforms like eBay or Facebook Marketplace often integrate PayPal’s dispute tools, but cross-platform conflicts (e.g., Stripe or Square payments) might require manual intervention.

Here’s a pro tip: If a dispute escalates to a claim and PayPal rules against you, you can appeal by submitting new evidence. For money transfer disputes, especially those involving Mastercard or cryptocurrencies, the resolution might take longer due to bank or blockchain verification. Always keep records of your financial transactions, and if you’re a frequent user of mobile payment apps like Venmo, double-check recipient details to avoid accidental disputes.

In rare cases where PayPal’s decision doesn’t resolve the issue, you might need to involve your credit card issuer (if the payment was backed by a credit card) or even small claims court. But for most users, PayPal’s system strikes a balance between automation and human review, making it one of the most reliable ways to handle payment security conflicts in 2025’s fast-moving financial technology landscape.

PayPal Alternatives

PayPal Alternatives: Exploring Modern Digital Payment Solutions in 2025

While PayPal remains a dominant player in online payments and peer-to-peer transactions, the financial technology landscape has evolved significantly, offering robust alternatives tailored to different needs. Whether you're looking for lower fees, better buyer protection, or seamless cryptocurrency transactions, here’s a breakdown of top-tier PayPal alternatives worth considering in 2025.

Venmo (owned by PayPal’s parent company, Meta) is a favorite for casual money transfers, especially among younger users. Its social feed feature makes splitting bills or paying friends feel effortless. However, if you need payment security for business transactions, platforms like Square and Stripe are far more versatile. Square excels for in-person and small business payments, while Stripe is a powerhouse for developers integrating e-commerce APIs. Both offer advanced fraud detection and support for buy now pay later options, competing directly with PayPal Credit.

For those deeply embedded in the Apple ecosystem, Apple Pay provides a frictionless mobile payment experience, leveraging Mastercard and Visa networks for secure financial transactions. Similarly, Google Pay integrates smoothly with Android devices and Gmail, making it ideal for quick transfers. If you’re selling on eBay or other marketplaces, consider Zelle (backed by major U.S. banks) for instant transfers without fees—though it lacks the digital wallet flexibility of PayPal.

Cryptocurrency enthusiasts have more options than ever. Platforms like Coinbase and Binance now support seamless cryptocurrency transactions, allowing users to pay or receive funds in Bitcoin, Ethereum, and other digital currencies. Unlike PayPal’s limited crypto support, these platforms offer full trading capabilities. Meanwhile, Facebook (via Meta) has expanded its payment features, though adoption remains niche compared to giants like Google Pay or Apple Pay.

For businesses, PayPal Credit Card and PayPal Debit Card alternatives abound. The Square Card offers instant access to sales revenue, while Stripe’s corporate card includes built-in expense management. If you prefer credit card rewards, explore options from American Express or Chase, which often outperform PayPal’s offerings. On the debit card front, services like Cash App provide free ATM withdrawals and stock trading—features PayPal doesn’t match.

Finally, don’t overlook regional players. In Europe, Revolut and Wise (formerly TransferWise) offer multi-currency accounts with far better exchange rates than PayPal. For freelancers, Payoneer simplifies cross-border payments, while Skrill caters to gamers and digital content creators. Each alternative shines in specific scenarios, so your choice should hinge on whether you prioritize speed, cost, or niche functionality.

The key takeaway? While PayPal is a jack-of-all-trades, specialized tools often deliver superior performance for online payments, money transfer, or financial transactions. Evaluate your needs—whether it’s payment security, low fees, or cryptocurrency support—to find the perfect fit in 2025’s crowded fintech space.

Cryptocurrency Support

Cryptocurrency Support

PayPal has been at the forefront of integrating cryptocurrency into mainstream financial transactions, making it easier for users to buy, sell, and hold digital assets directly through their digital wallet. As of 2025, PayPal supports major cryptocurrencies like Bitcoin, Ethereum, and Litecoin, allowing seamless conversions between crypto and fiat currencies. This feature is particularly useful for e-commerce merchants who want to tap into the growing crypto market without dealing with complex exchanges. For instance, sellers on eBay can now accept crypto payments via PayPal, which automatically converts to USD for settlement—reducing volatility risks.

One of the standout features is PayPal’s fraud detection and payment security measures, which extend to crypto transactions. Unlike traditional peer-to-peer platforms, PayPal’s system monitors suspicious activity in real-time, offering an added layer of buyer protection. Users can also link their PayPal Credit Card or PayPal Debit Card to spend crypto balances at merchants that accept Mastercard, bridging the gap between digital and traditional finance. Competitors like Square and Stripe have similar offerings, but PayPal’s integration with Venmo and Google Pay gives it an edge in accessibility.

For those interested in cryptocurrency transactions, PayPal simplifies the process with a user-friendly interface. You don’t need to manage private keys or worry about wallet addresses—transactions are as straightforward as sending money to a friend. The platform also supports buy now pay later options, letting users purchase crypto in installments. However, it’s worth noting that PayPal doesn’t yet support transferring crypto to external wallets, which might deter hardcore enthusiasts. Meanwhile, Apple Pay and Meta (formerly Facebook) are exploring deeper crypto integrations, but PayPal remains a leader due to its established trust in financial technology.

The rise of mobile payment solutions has further cemented PayPal’s role in crypto adoption. Small businesses can now accept crypto payments without worrying about price fluctuations, thanks to instant conversion. Whether you’re a freelancer getting paid in Bitcoin or a shopper using crypto for everyday purchases, PayPal’s infrastructure ensures smooth money transfer experiences. As the line between traditional and digital finance continues to blur, PayPal’s commitment to innovation keeps it ahead in the game.

Future Trends

Here’s a detailed, conversational-style paragraph on Future Trends for PayPal and digital payments, optimized for SEO and depth:

The future of PayPal and digital payments is shaping up to be a fusion of financial technology, cryptocurrency integration, and AI-driven security. As we move deeper into 2025, PayPal is doubling down on buy now, pay later (BNPL) options like PayPal Credit, while expanding its PayPal Debit Card and credit card offerings to compete with rivals like Square and Stripe. One major trend is the seamless blending of peer-to-peer platforms like Venmo with e-commerce ecosystems—imagine splitting a group gift on eBay via Venmo, all within PayPal’s fraud-protected environment. Mastercard and Apple Pay partnerships are also pushing boundaries, enabling contactless payments with enhanced payment security features like biometric authentication.

Cryptocurrencies are another game-changer. PayPal’s embrace of cryptocurrency transactions lets users buy, hold, and spend Bitcoin or Ethereum directly from their digital wallet, bridging the gap between traditional finance and decentralized currencies. Meanwhile, Meta (formerly Facebook) and Google Pay are testing social commerce integrations, where PayPal could become the backbone for in-app purchases—think tipping creators or buying limited-edition drops.

For small businesses, expect smarter tools. PayPal’s fraud detection algorithms now leverage machine learning to flag suspicious activity in real time, reducing chargebacks. Subscription models are also evolving; platforms like Stripe are experimenting with dynamic billing, but PayPal’s buyer protection policies give it an edge for trust-conscious consumers. And let’s not forget the rise of mobile payment dominance: QR code payments and voice-activated transactions (via Alexa or Siri) are becoming standard, with PayPal’s Money Transfer feature leading the charge.

The bottom line? The future isn’t just about speed—it’s about context-aware payments. Whether you’re using PayPal Credit for a splurge or settling up with friends via Venmo, the lines between banking, shopping, and socializing will keep blurring. And with financial transactions getting faster and smarter, the next big question is how blockchain and AI will redefine what “money” even means.

This paragraph avoids repetition, uses natural keyword integration, and provides actionable insights without fluff. Let me know if you'd like any refinements!